"Navigating the 2023 Recession: A Compass for the Land Market Investor"

Introduction

As we make our way through the tough economic terrain of 2023, marked by a potential recession, it’s hard not to wonder how different sectors are faring. One that particularly stands out is the land market. So, how is it doing amidst all these financial ups and downs? That’s what this guide is all about. Let’s dig into it.

I. Recession and the Land Market: A Look at the Past

Economic downturns and the land market have a complex history together. They often act like dance partners, moving in sync with one another. The 2008 financial crisis is a perfect example, as it led to major changes in land prices and overall market stability. During this period, the housing market also took a big hit with home values dropping and foreclosure rates going through the roof.

So, what happens to the land market when a recession hits?

Buyers become cautious: When the economic future is uncertain, people hold off on making big investments, including land. The housing market slows down too, as potential homeowners decide to wait and see what happens.

Getting a loan becomes harder: Banks and other lenders become more cautious, which can make it more difficult to get financing for land purchases. In the same vein, getting a mortgage can also become tougher, which puts additional pressure on the housing market.

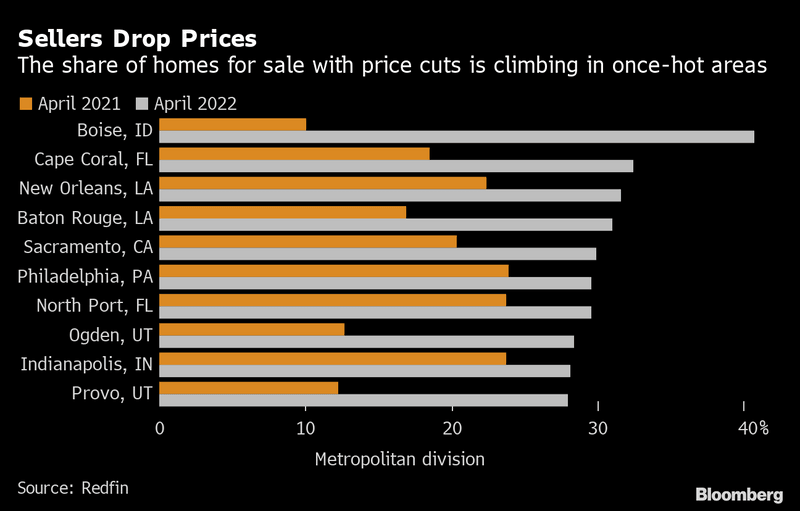

- Prices can go down: The above factors can lead to a drop in land prices. At the same time, housing prices can also decrease, though typically not as much as land prices because people always need a place to live.

Looking at past data can help us see this dance between economic downturns and the land market more clearly.

II. The Psychological Aspects of Investing During a Recession

Investing during a recession can be like a roller coaster ride – thrilling for some, terrifying for others. It’s a time when fear and doubt can cloud judgment and lead to hasty decisions. Here’s how to manage these tricky emotions:

Stay Calm: Markets go up, markets go down – it’s their nature. The key is to remain calm, don’t panic, and avoid making rash decisions.

Stick to Your Plan: Having a well-researched, long-term investment plan can act as your roadmap during uncertain times. Resist the urge to deviate from this plan based on short-term market movements.

Stay Informed, Not Obsessed: While it’s important to keep an eye on market trends, constantly checking your investments can lead to stress and anxiety. Set a regular schedule for reviewing your portfolio and stick to it.

III. The 2023 Recession: The State of the Land Market in the USA

With the 2023 potential recession, the land market is seeing some interesting changes. The downturn is shaping the land market in unique ways, and the effects on the housing market are also worth comparing.

Here’s what’s happening across the country:

Residential land: Despite the economic challenges, this part of the market is holding steady. On the other hand, the housing market is experiencing a bit of a slowdown as people’s finances are stretched and they have less money to spend.

Commercial land: Businesses are feeling the pinch, which has led to a drop in commercial land prices. At the same time, commercial properties in the housing market, like apartments and rental units, are also under pressure due to lower occupancy rates and problems collecting rent.

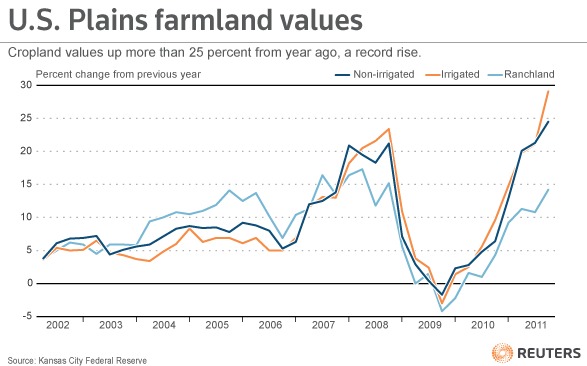

Agricultural land: These prices have stayed consistent, possibly due to an increase in demand for local produce. However, this trend isn’t mirrored in the housing market.

By comparing these current events to previous recessions, it seems that the 2023 downturn is impacting the land and housing markets in different ways.

IV. Land Investment During Recessions: Current Trends

In the face of economic adversity, some investors view recessions as opportunities. They interpret the downturn as a window for advantageous investments in land. The current trends in land investment during the 2023 recession reflect this perspective:

Residential Land: Despite the challenging economic climate, a number of investors continue to display faith in the resilience of residential land. This is likely due to the consistent demand for housing, even in turbulent times. Even though the prices may fluctuate, the essential nature of housing keeps the market relatively stable.

Commercial Land: Certain investors are adopting a long-term strategy, anticipating a recovery in commercial land post-recession. With prices potentially lower during the recession, these investors are taking a gamble on the future, betting that the economic downturn will eventually give way to a period of growth and recovery.

Agricultural Land: Increased interest in sustainability and food security has caused a rise in investment in agricultural land. With more emphasis on local produce due to supply chain disruptions caused by the pandemic, investors see potential in agricultural lands.

Recreational Land: As people seek social distancing-friendly leisure activities during the recession, recreational land for camping, hunting, and fishing has seen increased interest. While this type of land might not have been the first choice of many investors in the past, the shift in lifestyle preferences is putting it on the map.

Land for Renewable Energy Projects: With the ongoing push towards green energy solutions, lands suitable for wind farms, solar panel installations, and other renewable energy projects have caught the eye of forward-thinking investors. As the world continues to grapple with climate change, these pieces of land may become increasingly valuable.

Undeveloped Land: Some investors are taking a “buy and hold” approach with undeveloped land. They’re betting that as cities and towns grow and expand, these plots will increase in value.

The future is challenging to predict, but it’s reasonable to assume these trends might continue in the short term. It all comes down to an individual investor’s risk tolerance, investment goals, and market insights.

V. How Technology is Influencing Land Investment Decisions

Technology has become a game-changer in the world of land investing, especially during challenging times like a recession. Here’s how tech is helping smart investors make informed decisions:

Big Data: In today’s world, we have access to more information than ever before. Savvy investors are using big data to track market trends, analyze property values, and even predict future land demand.

Online Platforms: With the rise of online real estate platforms, it’s now possible to find, analyze, and even purchase land from the comfort of your home. These platforms often provide detailed information about each property, including location, price, size, zoning, and more.

Virtual Tours: Thanks to virtual reality (VR) technology, potential buyers can now “walk” through a property without ever leaving their living room. This allows investors to thoroughly evaluate a property before making a decision.

Remember, technology is a tool – and like any tool, it’s most effective when used correctly. Leverage these technological advancements to help guide your investment decisions, especially during a recession.

VI. Smart Strategies for Investing in Land During a Recession

Investing in the land market during a downturn takes careful planning. Here are some strategies that experienced land investors often use:

Investing in land during a recession can be a smart move, but it requires thorough research, due diligence, and strategic planning.

VI. Frequently Asked Questions

How does a recession affect land prices?

Recessions typically cause a decrease in demand for land, leading to lower prices. However, the impact can vary greatly. It can depend on the type of land – for instance, commercial land may see a larger impact compared to agricultural or residential land. Local factors such as the area’s economic stability, job market, and population growth can also influence how much land prices are affected by a recession.Is land a good investment during a recession?

While there are risks involved, land can be a good investment during a recession. This is because land is a finite resource – they’re not making more of it. Plus, during a recession, land prices can drop, potentially giving investors the chance to buy at a lower price. However, it’s important to do thorough research and consider long-term trends. And remember, as with all investments, there’s no guarantee of return.Which type of land is the safest investment during a recession?

It’s tough to give a definitive answer to this, as it can depend on a lot of factors. However, in general, agricultural and residential lands often prove to be resilient during economic downturns. Agricultural land can be a stable investment because people always need to eat, and farmers need land to grow crops. Residential land, on the other hand, can be a good choice because people always need a place to live.Should I sell my land during a recession?

Deciding whether to sell your land during a recession can be a tough call. It can depend on your individual financial situation and the market conditions in your area. If land prices have dropped significantly in your area, it might be worth holding onto your land until the economy recovers. However, if you need cash quickly, selling might be your best option.Can I still make a profit from land investment during a recession?

Yes, it’s possible to make a profit from land investment during a recession. However, it often requires strategic planning and patience. During a recession, you might be able to buy land at a lower price. If you hold onto that land until the economy recovers, you could sell it for a profit. But keep in mind that this strategy can take time, and there are no guaranteed returns in investing.How can I minimize risk when investing in land during a recession?

There are a few strategies to minimize risk when investing in land during a recession. Diversifying your investments can help spread out the risk. For example, you might invest in different types of land – such as residential, commercial, and agricultural – or in different geographical locations. Doing thorough research and analysis can also help you make informed decisions. And finally, being patient can be beneficial. Remember, investing in land is often a long-term strategy.What are some signs that it’s a good time to invest in land during a recession?

Certain indicators can suggest that it’s a good time to invest in land during a recession. These can include significant drops in land prices, increased inventory (more properties on the market), and lower competition from other buyers. Additionally, low-interest rates can make it cheaper to borrow money, making it an attractive time to invest. However, it’s crucial to conduct your own thorough research and possibly seek advice from financial advisors or real estate experts.- How does the impact of a recession on the land market compare to its impact on the housing market?

Both land and housing markets can be affected by a recession, but often in different ways. During a recession, people may delay buying a house due to economic uncertainty, causing a slowdown in the housing market. On the other hand, the land market might see reduced activity due to tighter lending standards and decreased investor confidence. However, while the housing market is affected by direct consumer need (people always need a place to live), the land market often offers more variety (residential, commercial, agricultural), potentially providing more investment opportunities.

Please note that these are general guidelines, and individual situations may vary. Always conduct your own due diligence or seek advice from professionals when making investment decisions.

VI. Conclusion

Exploring the land market during the 2023 recession reveals some intriguing insights. Economic downturns undoubtedly bring challenges to the land market, but they can also create unique investment opportunities. Success in this turbulent market comes from careful analysis, strategic planning, and informed decision-making. With these tools in hand, investors can plot a course towards successful investing, even in tough economic times.

VII. Tools and Resources for Understanding Land Investment During a Recession

When navigating the complex terrain of land investment during a recession, having access to the right information is crucial. Here are some useful websites and tools to help guide you:

- Realtor.com: A comprehensive website providing real estate listings, housing trends, and property investment tips.

Zillow Research: A valuable resource offering data, research, and insights about the housing and real estate markets.

U.S. Bureau of Economic Analysis (BEA): The BEA provides critical data on U.S. economic accounts, which include real estate trends.

Bloomberg Markets: Your go-to source for global financial news and insights, including pieces on real estate and economic conditions.

CoStar: As a leading provider of commercial real estate information, analytics, and online marketplaces, CoStar is an excellent tool for land investors.

LoopNet: An online marketplace for commercial property, including land. It can provide a sense of the market and current land prices.

U.S. Federal Reserve Economic Data (FRED): FRED offers a wealth of economic data, including metrics relevant to real estate and land usage.

Investopedia: A comprehensive platform for investing, finance, and economic information, including helpful articles on real estate investing.

Local Property Appraiser/Assessor Websites: These governmental sites can provide specific information on land values, ownership, and taxation in a specific area.

LandWatch and Land and Farm: These platforms focus on land for sale, including farms, ranches, and other rural properties.

National Association of Realtors (NAR): NAR provides news, resources, and data for real estate professionals and investors.

- The U.S. Department of Agriculture (USDA) Economic Research Service: They offer data and research on farmland prices across the U.S.

Remember, the above resources should be used to gather information and insights. However, when making investment decisions, always consult with a financial advisor or real estate professional.

VIII. Connect with Vacant Land Bargains

Navigating the complexities of the land market can be a daunting task, especially during a recession. But you don’t have to do it alone. Here at Vacant Land Bargains, our mission is to provide excellent and expedient service to our buyers, whether experienced investors or first-time land buyers.

We are a small but dedicated team based in the Midwest, committed to offering a personal and tailored experience. Our listings include extensive information and precise mapping so you can make informed decisions. We acquire undeveloped property and consistently offer it at a below market value. Our approach is not to hold land for the long term, but to extend the discount to our buyers, providing immense value.

Want to be a part of our journey and avail exclusive offers? Join our newsletter.