1. Introduction

Imagine this: You’re about to make a big land investment, but instead of just considering the price or location, you also take into account the environmental impact. Sounds like a dream, right? Well, hold on to your hats, because sustainable real estate is not just a trend, it’s the future of the industry. In this article, we’ll explore how to make your next land investment not just profitable, but also eco-friendly.

2. A Deep Dive into Sustainable Real Estate

When we talk about sustainable real estate, we’re venturing into a landscape where the pillars of environmental responsibility and conservation are firmly rooted. But what exactly does that mean?

Environmental responsibility, in this context, refers to the commitment to reduce negative impacts on the environment caused by conventional real estate practices. It’s about going beyond the basic laws and regulations to incorporate practices that preserve and even enhance our surroundings. This involves making conscious decisions throughout the entire lifecycle of a property – from its design and construction, to its management and eventual repurposing or demolition.

Think about buildings designed to optimize natural light to reduce energy consumption, or structures that incorporate rainwater harvesting systems to minimize water waste. There’s also the element of using sustainable, locally-sourced materials, and ensuring waste is effectively managed during construction and operational phases. This focus on environmental responsibility is not just about limiting harm, it’s about actively contributing to environmental health and resilience.

Now, let’s talk about conservation. Conservation in sustainable real estate takes into account the protection and preservation of the natural environment in which the property exists. It’s about maintaining the balance between human activities and the preservation of ecosystems, biodiversity, and natural resources.

Imagine properties that are designed to minimize their impact on local wildlife, with careful consideration given to land use, landscaping, and even the choice of exterior lighting to avoid disturbing nocturnal animals. Or envision developments that incorporate green spaces, native plantings, and habitat restoration efforts to support local biodiversity. This commitment to conservation aims to ensure our real estate investments leave a positive, rather than destructive, mark on the environment.

At the heart of sustainable real estate is the concept of living and building in harmony with nature, rather than trying to dominate or subdue it. It’s a commitment to creating spaces that not only serve our needs as humans but also respect and protect the environment.

So, how does all of this tie into land investment? It means seeking out and investing in properties that embody these principles. It means prioritizing parcels of land that have been, or can be, developed in a manner that upholds environmental responsibility and promotes conservation. In essence, sustainable real estate takes land investment beyond the realm of financial returns, into a space where every decision can contribute to the health and sustainability of our planet.

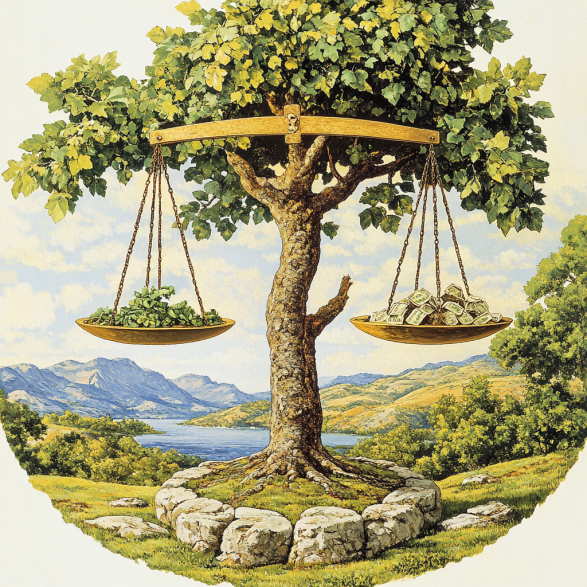

3. The Intersection of Land Investment and Environment

Land investment, at its simplest, is the purchase of land as an asset. But when we layer sustainability onto it, things get a whole lot more interesting. We’re talking about choosing land that has the potential for green development, supports biodiversity, or could be a haven for conservation. Land characteristics such as soil health, flood plains, and potential for renewable energy production are critical considerations. In other words, it’s not just about what the land can give to you, but what it can give back to the environment too.

4. The How-to of Eco-conscious Land Investment

Finding your footing in sustainable real estate can feel a little daunting at first, but fret not! The journey into eco-conscious land investment is a rewarding one. Let’s break it down to some crucial elements:

- The Location: Support for Sustainable Practices

The first thing to take into account is the location of the land. You want to invest in an area that supports and encourages sustainable practices. Consider locations where local ordinances and community practices favor green development. For instance, some cities or regions offer incentives for developments that include renewable energy systems or sustainable wastewater management.

A great example of this would be Freiburg, Germany, known for its advanced ecological planning. The city is characterized by solar-powered homes, extensive cycling routes, and energy-efficient buildings – a testament to the city’s commitment to sustainable living.

2. The Local Ecosystem: Protecting Local Wildlife and Unique Landscapes

Next, you want to ensure your investment isn’t detrimental to local wildlife or unique landscapes. Research the local ecosystem thoroughly. You wouldn’t want your development to disrupt a crucial habitat or damage an ecologically sensitive area. Investing in land with diverse ecosystems can provide long-term benefits, like improved soil health or water quality, that enhance the property’s value.

Take, for instance, a land parcel near a marshland. Marshlands are important habitats for a wide variety of flora and fauna, some of which might be endangered. Here, it’s crucial to conduct an Environmental Impact Assessment (EIA) before any development. EIAs identify potential environmental effects of proposed actions, helping to avoid or minimize negative impacts.

3. Potential for Sustainable Development: Minimizing Environmental Harm

A sustainable land investment should have potential for green development. Consider if the land can be developed in a way that prioritizes resource efficiency, sustainable materials, and minimal disruption to the natural landscape.

One example of sustainable development is the concept of green roofs, where the roofs of buildings are covered with vegetation. Not only do they provide insulation and reduce the need for heating and cooling, but they also create a habitat for wildlife and improve local air quality. So, if your land has the potential for such developments, it’s a green flag!

4. Inspiration and Knowledge from Successful Eco-friendly Properties

Lastly, it’s essential to learn from the successes of others. Look for examples of eco-friendly properties and draw inspiration from them. Whether it’s an eco-village in the Netherlands or a sustainable mixed-use development in Singapore, understanding their strategies and implementations can inform your own investment decisions.

Remember, eco-conscious land investment isn’t just about profit – it’s about playing your part in preserving the environment for future generations. It might take a bit of extra legwork, but the results are more than worth it.

Jump on the green bandwagon because sustainable real estate is here to stay! More than just a fleeting trend, it’s becoming the standard in property development and investment. As awareness about our environmental impact grows, people are not only desiring but expecting properties to have green features. This includes land-specific trends such as investing in land suitable for conservation easements, land trusts, regenerative agriculture or the increased demand for rural properties with sustainable features.

Here are a few green features that are becoming popular in sustainable real estate:

- Energy-Efficient Appliances and Systems: These devices are designed to use less energy for the same output compared to conventional appliances. This results in lower utility bills and a reduced carbon footprint. For example, energy-efficient washing machines use less water and electricity per load.

- Solar Panels: Solar panels capture sunlight and convert it into electricity, providing a renewable and clean source of energy for homes. This reduces reliance on fossil fuels and can significantly decrease energy bills.

- Rainwater Harvesting Systems: These systems collect and store rainwater, which can be used for irrigation, flushing toilets, or washing cars. This reduces the demand for fresh water and helps prevent stormwater runoff, a significant contributor to water pollution.

- Green Roofs: Green roofs are covered with vegetation, which provides insulation, reduces the heat island effect, and creates a habitat for local wildlife. They can also improve local air quality and provide aesthetically pleasing spaces for residents.

- Natural Ventilation: Instead of relying solely on air conditioning, buildings can be designed to facilitate airflow and regulate temperature naturally. This reduces energy consumption and creates a healthier indoor environment.

- Sustainable Building Materials: Materials such as bamboo, recycled steel, or reclaimed wood are sustainable alternatives to conventional building materials. They reduce the demand for new resources and can create unique and appealing aesthetic features.

- Smart Home Technology: Smart thermostats and lighting systems can optimize energy use based on when occupants are home and their comfort preferences. This leads to both energy savings and increased convenience for homeowners.

- Electric Vehicle Charging Stations: With the rise in electric vehicles, having an on-site charging station has become a sought-after feature. It encourages the use of electric vehicles, reducing greenhouse gas emissions.

These trends in green real estate are not just a nod towards environmental responsibility, but also a savvy business move. By focusing on these features, you can make your land investment stand out in a crowded market, attracting eco-conscious buyers and potentially increasing your return on investment.

6. Key Factors in Sustainable Land Investment

- Existing Regulations in the Area

Local regulations can significantly impact the feasibility and direction of sustainable development. Some states have rigorous guidelines and requirements for green buildings, while others offer incentives to encourage such developments. For instance, California is well-known for its stringent building codes, designed to reduce energy consumption and greenhouse gas emissions. On the other hand, New York City offers property tax abatements to buildings that install green roofs.

Understanding the local legal landscape can help you make informed decisions about your land investment. You need to be sure that your vision for sustainable development aligns with the local regulatory framework.

- Market Demand for Green Properties

Market demand is another crucial aspect to consider. The appetite for green properties is growing, but it can vary depending on location, demographic factors, and awareness levels about sustainability. It’s important to assess whether there’s a strong market for green properties in the area you’re considering. Look at trends, property values, and sales rates for green homes in comparison to standard properties.

- Environmental Impact Assessment (EIA)

An Environmental Impact Assessment (EIA) is a process that evaluates the potential environmental effects of a proposed activity or development. It examines various aspects, including potential harm to wildlife, changes to the local ecosystem, impacts on water quality, and much more.

Conducting an EIA is not just about meeting regulatory requirements—it’s a vital tool in sustainable land investment. It can help you understand how to develop the land in an environmentally responsible manner and identify any potential challenges early.

- The Role and Cost of Green Building

Green building is a cornerstone of sustainable real estate. It involves using energy-efficient designs, sustainable materials, and construction techniques that minimize environmental impact. However, it’s important to note that green building can sometimes involve higher upfront costs compared to conventional construction.

Despite this, green buildings can offer significant cost savings over time. They can reduce energy and water consumption, which translates to lower utility bills. They often require less maintenance and can command higher rent or sale prices. According to a report by the World Green Building Council, most green buildings can achieve a breakeven point within eight years of construction.

To sum up, successful sustainable land investment requires a deep understanding of local regulations, market dynamics, environmental considerations, and the implications of green building. With these elements in mind, you can align your investment with both profitability and environmental stewardship.

7. A Glimpse into the Future of Sustainable Land Investment

The sustainable real estate market is poised to grow even further. As more people become conscious of their impact on the environment, the demand for green properties is likely to rise. The future may also bring new and innovative methods of green building and eco-development, so it’s an exciting time to be a part of this industry.

Conclusion

In a nutshell, making a land investment with environmental impact is not just good for the planet, it’s also good for your wallet. By focusing on sustainable real estate, you can play a part in conserving our planet, while also reaping the benefits of a burgeoning market. So, are you ready to make your next land investment a sustainable one?

FAQs

What is sustainable real estate?

A: Sustainable real estate refers to properties that are developed or managed in environmentally responsible ways, taking into account factors such as energy efficiency, waste management, and conservation of natural resources.

How can I make my land investment environmentally friendly?

A: Consider the potential environmental impacts of your land investment, including potential harm to local wildlife, damage to unique landscapes, and the overall sustainability of the area. Also consider land characteristics such as soil health, flood plains, and potential for renewable energy production.

What are the trends in the green real estate market?

A: Trends in the green real estate market include a demand for energy-efficient homes, sustainable building materials, green infrastructure like solar panels, as well as investing in land suitable for conservation easements, land trusts, and regenerative agriculture.

What characteristics should I look for in a sustainable land investment?

A: Look for land that supports biodiversity, has the potential for green development, or could serve as a conservation area. Consider land characteristics such as soil health, flood plains, and potential for renewable energy production.

How can sustainable land investment contribute to overall portfolio diversification?

A: Sustainable land investment can offer a unique avenue for portfolio diversification. As more people become environmentally conscious, the demand for properties developed with sustainability in mind will increase. This can offer investment opportunities with potentially higher returns while contributing to a more sustainable future.