Investing in land in the US is akin to uncovering a goldmine. The allure is undeniable – a plethora of potential, a promise of profits, and a sense of pride in owning a piece of the American dream. But beyond the exciting prospect lies a complex terrain littered with hidden expenses. Unprepared, these covert costs can transform your dream investment into a startling nightmare. But, no need for cold feet! With due diligence, savvy strategies, and this enlightening guide, you’ll be primed for navigating the ins and outs of US land buying.

I. The Landscape of Land Buying in the US

A. The Rising Trend of Land Buying

In the past, buying land in the US was often seen as a luxury reserved for the wealthy or large corporations looking to expand their portfolios. It was a domain dominated by tycoons and major investors who had the resources and insider knowledge to navigate the complexities of land acquisition. However, in recent years, this perception has shifted significantly.

Today, land buying is accessible to a broader audience, including first-time buyers, small-scale investors, and even those looking to secure a piece of property for personal use. This democratization of land ownership is driven by several factors:

- Increased Awareness: With the rise of real estate education platforms and online resources, more people are becoming informed about the benefits of land ownership. This knowledge has empowered individuals from various backgrounds to explore land buying as a viable investment option.

- Affordability: Contrary to popular belief, not all land is prohibitively expensive. In fact, there are many opportunities to purchase land at affordable prices, particularly in rural or undeveloped areas. This affordability has made land buying attractive to a wider demographic, including those who might not have previously considered it.

- Diverse Investment Opportunities: The potential uses for land are vast, ranging from residential development and agriculture to commercial ventures and recreational spaces. This versatility means that land can appeal to a wide range of investors, each with their own goals and visions for the property.

- Long-Term Value: Land is a finite resource, and its value tends to appreciate over time, especially as urban areas expand and demand for land increases. This long-term growth potential is a major draw for investors looking to build wealth over time.

However, while the doors to land buying have been flung open to a broader audience, it’s essential to recognize that the process is not without its challenges. Understanding the landscape of land buying requires more than just enthusiasm—it demands a strategic approach, a solid understanding of the market, and an awareness of the potential pitfalls that could arise. Knowledge, as they say, is your compass in this journey, guiding you toward a successful and profitable investment.

B. Visible and Hidden Costs in Property Buying.

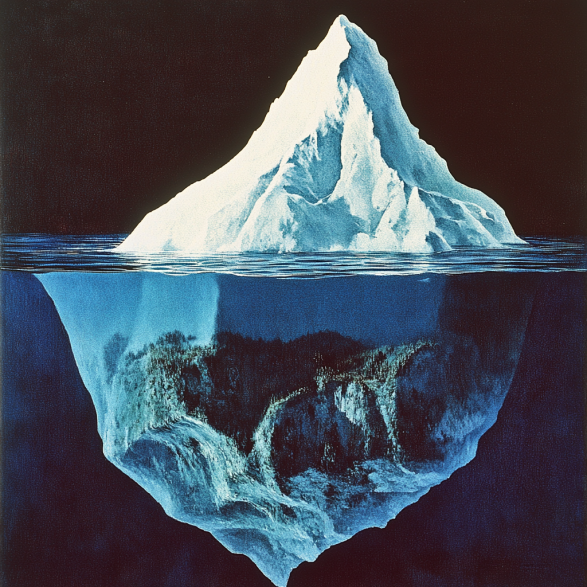

When considering the purchase of land, the initial focus is often on the visible costs—the price tag you see in the listing, the broker’s fees, and the closing costs. These are the expenses that are easy to quantify and plan for, and they’re the ones that most buyers are prepared to cover. However, much like an iceberg, the true cost of buying land is often hidden beneath the surface.

1. Visible Costs: The Tip of the Iceberg

- Purchase Price: This is the most obvious and straightforward cost. It’s the amount you agree to pay for the land, and it’s usually the first number that catches your attention. While it’s a significant figure, it’s only part of the overall financial picture.

- Broker’s Fee: If you’re working with a real estate broker, their fee is another visible cost. Brokers typically charge a commission, which is a percentage of the purchase price. This fee is usually negotiable, but it’s important to factor it into your budget.

- Closing Costs: These are the fees and expenses that need to be paid at the finalization of the sale. Closing costs can include loan origination fees, title insurance, appraisal fees, and recording fees. They are often overlooked by first-time buyers but can add up to a substantial amount.

- Property Taxes: Once you own the land, you’re responsible for paying property taxes. These taxes are typically assessed annually and are based on the value of the land. The rates can vary significantly depending on the location of the property.

2. Hidden Costs: What Lies Beneath

While the visible costs are relatively easy to identify, the hidden costs are where many buyers find themselves in over their heads. These expenses can be less obvious, but they can have a significant impact on the total cost of ownership:

- Legal and Survey Fees: Before finalizing the purchase, it’s crucial to ensure that the land’s boundaries are clearly defined and that there are no legal disputes or claims on the property. This often requires a professional land survey, which can be costly. Additionally, you may need to hire an attorney to review the contracts and ensure that the transaction is legally sound.

- Environmental Assessments: Depending on the land’s location and previous uses, you may need to conduct environmental assessments to check for issues like soil contamination, wetlands, or flood risks. These assessments are essential for ensuring that the land is suitable for your intended use, but they can be expensive and time-consuming.

- Zoning and Permit Fees: Before you can develop the land or use it for a specific purpose, you may need to obtain zoning approvals and permits from local authorities. The cost of these permits can vary widely depending on the type of development you’re planning, and the process can be complex and lengthy.

- Utility Hookups: If the land is undeveloped, you’ll need to arrange for utilities like water, electricity, and sewage to be connected to the site. The cost of installing these utilities can be substantial, especially if the land is in a remote area where infrastructure is limited.

- Ongoing Maintenance: Even if you’re not planning to develop the land immediately, you’ll still need to maintain it. This could involve tasks like clearing brush, maintaining access roads, and managing vegetation. These ongoing costs can add up over time and should be factored into your budget.

- Potential Tax Implications: Depending on how you intend to use the land, there may be additional tax implications to consider. For example, if you plan to develop the land for rental properties, you’ll need to account for taxes on rental income. Understanding these implications is crucial for accurate financial planning.

While the prospect of buying land in the US is exciting and full of potential, it’s essential to approach the process with a clear understanding of both the visible and hidden costs involved. By doing your due diligence, asking the right questions, and planning for all potential expenses, you can avoid unpleasant surprises and ensure that your investment is both successful and sustainable. Remember, what you see on the surface is just the beginning—true understanding lies in uncovering what’s hidden beneath.

II. Navigating Hidden Costs: Tips and Strategies

When it comes to buying land, the excitement of securing a piece of property can sometimes overshadow the more mundane, yet crucial, aspects of the process—namely, the hidden costs. These expenses, if not properly accounted for, can turn what seems like a great deal into a financial strain. However, with the right strategies and a proactive approach, you can successfully navigate these hidden costs and protect your investment. Here’s how:

1. Do Your Homework

The first and most important step in navigating hidden costs is to arm yourself with knowledge. Understanding the local landscape—both figuratively and literally—is crucial. This means delving into zoning regulations, local tax laws, and any restrictions that might affect your intended use of the land.

Zoning Regulations: Zoning laws dictate how land can be used—whether for residential, commercial, agricultural, or industrial purposes. Before purchasing, ensure that the land is zoned for your intended use. If not, you might face costly rezoning fees or, worse, find out that your plans for the property aren’t feasible at all. Additionally, some areas have restrictions on building sizes, types, or even the number of structures that can be erected, all of which can add unexpected costs.

Tax Implications: Property taxes vary widely depending on the location and intended use of the land. Familiarize yourself with the local tax rates and understand how they apply to your situation. Also, be aware of any potential tax incentives or exemptions that might apply to your purchase. For example, land used for agricultural purposes might qualify for reduced tax rates, but this could change if you later decide to develop the land.

Environmental Laws: Certain areas might be subject to environmental protection laws that can limit or complicate development. For instance, if the land contains wetlands or is in a protected wildlife area, you might face restrictions that could lead to costly environmental assessments or even prevent development altogether.

The more you know upfront, the fewer surprises you’ll encounter down the road. Investing time in research can save you significant money and headaches later.

2. Get a Professional Survey

One of the most critical steps in the land-buying process is obtaining a professional survey. This is not an area where you want to cut corners, as a survey provides a clear and accurate picture of what you’re actually buying.

Boundary Identification: A professional survey clearly marks the boundaries of your property, ensuring there are no disputes with neighboring landowners. Boundary disputes can be both costly and time-consuming, potentially leading to legal battles that could have been avoided with a proper survey.

Identifying Easements and Rights of Way: Surveys can also identify any easements or rights of way that might affect your use of the land. Easements allow others certain uses of your property, such as access to a public road, which could impact where you can build or develop.

Topographical Information: A detailed survey will also provide information about the topography of the land, identifying any potential challenges like steep slopes, flood zones, or unstable soil that could complicate construction and add to your development costs.

While a professional survey requires an upfront investment, it’s a crucial step in protecting yourself from unforeseen issues that could arise after the purchase.

3. Consider Future Costs

When budgeting for your land purchase, it’s important to think beyond the initial costs and consider future expenses. These ongoing and potential future costs can have a significant impact on your investment:

Maintenance Costs: Even undeveloped land requires some level of maintenance. You’ll need to consider the cost of keeping the land clear of overgrowth, managing access roads, and ensuring that the property remains in good condition. Neglecting maintenance can lead to more significant issues over time, potentially reducing the land’s value or usability.

Utility Connection Costs: If the land is in a remote or undeveloped area, connecting utilities like water, electricity, and sewage can be a major expense. It’s essential to research the availability of these services before purchasing and get estimates for the cost of installation. In some cases, the cost of bringing in utilities can be prohibitively high, significantly impacting the overall feasibility of your project.

Development Costs: If you plan to develop the land, whether for building a home, starting a business, or other purposes, you need to account for the costs associated with obtaining the necessary permits and adhering to local building codes. This includes fees for permits, inspections, and any required environmental assessments. Additionally, unexpected issues can arise during development, such as discovering that the soil isn’t suitable for building or that the land requires extensive grading or drainage work, all of which can add to your costs.

Potential Zoning Changes: While you might purchase land with a specific use in mind, future zoning changes by local authorities could affect your plans. For example, a residentially zoned area might be reclassified for commercial use, impacting the value and usability of your property. Keeping an eye on local planning and development trends can help you anticipate and prepare for these changes.

III. Financing Your Land Purchase

You’ve done your homework, you understand both the visible and hidden costs, and you’re ready to take the plunge into land ownership. But before you can claim your slice of paradise, you need to figure out how to pay for it. Financing land is a bit different from securing a mortgage for a home, and the options available each come with their own set of considerations. Let’s dive into the most common financing methods and what you should know about each.

1. Land Loans

Land loans are the go-to option for many people looking to purchase undeveloped land. However, they are not as straightforward as home loans. Here’s why:

- Higher Down Payments: Because land loans are considered riskier than home loans, lenders often require a higher down payment—sometimes as much as 20% to 50% of the land’s purchase price. This is because, from a lender’s perspective, it’s easier to resell a house than an undeveloped plot of land if the borrower defaults.

- Interest Rates: Land loans typically come with higher interest rates compared to home loans. The reasoning is similar to that of the down payment: undeveloped land doesn’t generate income or provide shelter, making it a riskier investment for lenders.

- Shorter Loan Terms: Unlike home loans that can stretch up to 30 years, land loans often have shorter repayment terms, ranging from 5 to 15 years. This means higher monthly payments, so it’s important to budget accordingly.

- Types of Land Loans: There are generally three types of land loans:

- Raw Land Loans: These are the riskiest and are used for land with no improvements—no utilities, roads, or clear plans for development. Lenders are cautious with these, so expect the highest down payments and interest rates.

- Unimproved Land Loans: This type of loan is for land that has some utilities and access, but still requires significant development. These loans are slightly easier to obtain than raw land loans but still come with high costs.

- Improved Land Loans: These loans are for land that is ready for construction, with access to utilities, roads, and other amenities. They are the easiest to obtain among the three, often with better terms.

While land loans can be a viable option, the higher costs associated with them mean that you need to be financially prepared and have a clear plan for the land’s use to convince lenders of the land’s potential.

2. Seller Financing

Seller financing is another option that has gained popularity, especially in the world of land purchases. Here’s how it works and what to consider:

- Easier Qualification: One of the biggest advantages of seller financing is that it often has more relaxed qualification criteria. Traditional lenders usually require a good credit score, a strong financial history, and significant documentation. In contrast, seller financing typically involves a more straightforward negotiation between you and the seller, making it accessible to a broader range of buyers.

- Flexible Terms: Because you’re dealing directly with the seller, there’s room for more flexible terms. You might be able to negotiate a lower down payment, a longer repayment period, or even a lower interest rate, depending on the seller’s situation and your negotiation skills.

- Higher Interest Rates: On the flip side, seller financing often comes with higher interest rates than traditional loans. The seller is taking on the risk that a bank or mortgage lender would typically bear, and they’ll want to be compensated for that risk.

- Shorter Repayment Periods: Like land loans, seller-financed deals often have shorter repayment periods, sometimes 5 to 10 years. This means higher monthly payments, so you need to ensure that your budget can handle the strain.

- Balloon Payments: Be cautious of balloon payments, which are lump-sum payments due at the end of a loan term. These can be a feature of seller-financed loans. If you can’t pay the balloon payment when it’s due, you might need to refinance or risk losing the property.

Seller financing can be a great way to bypass traditional financing hurdles, but it requires careful planning and a clear understanding of the terms to avoid potential pitfalls.

3. Home Equity Loan

If you already own a home and have built up equity, a home equity loan can be a viable option for financing your land purchase. However, this approach comes with its own set of risks and rewards:

- Using Your Home as Collateral: The biggest advantage of a home equity loan is that you’re using your existing home as collateral, which typically allows for lower interest rates and better loan terms than an unsecured loan. However, this also means that your home is on the line. If you fail to make payments, you risk foreclosure on your primary residence.

- Lower Interest Rates: Home equity loans generally offer lower interest rates compared to land loans or seller financing. This is because they’re secured against your property, making them less risky for lenders.

- Fixed Repayment Terms: Home equity loans often come with fixed repayment terms and fixed interest rates, giving you predictable monthly payments. This can be helpful in managing your budget.

- Consideration of Total Debt: When taking out a home equity loan, consider how the additional debt will affect your overall financial situation. It’s crucial to ensure that you can comfortably manage both your existing mortgage payments and the new loan.

- Not the First Choice: While a home equity loan can be a smart way to finance a land purchase, it’s generally considered a last resort. Using your home as collateral for a non-essential purchase like land can be risky. Before proceeding, evaluate your financial stability and consider whether the investment in land justifies putting your home at risk.

IV. The Role of Real Estate Professionals

You wouldn’t navigate a ship through a storm without a seasoned captain, would you? Similarly, having experienced professionals by your side can help you steer clear of hidden rocks (read: costs) in your land buying journey.

-Real Estate Agents and Brokers: They’re your navigators, guiding you through the buying process. Their expertise can save you time, and more importantly, money.

-Lawyers: Legal eagles come in handy when dealing with complex transactions. They ensure all contracts are kosher, saving you from future legal battles.

-Surveyors: These folks are the cartographers of the land buying world. They define your territory, helping avoid disputes with neighbors down the line.

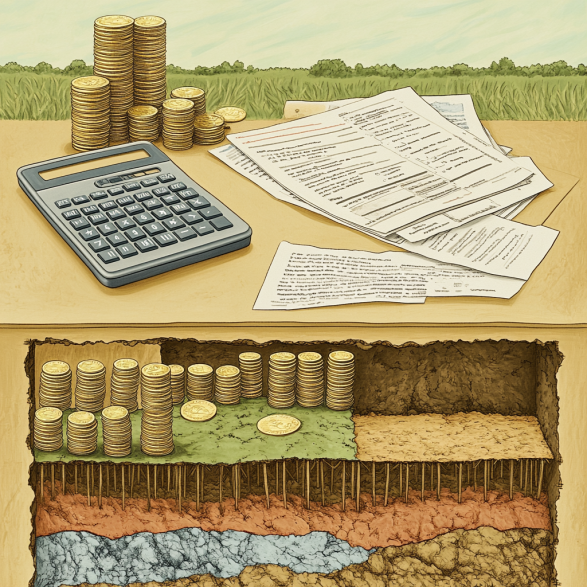

V. Cost-Benefit Analysis of Land Buying

The art of buying land isn’t just about understanding costs but also about measuring them against potential benefits. Like a seasoned prospector, you need to weigh the gold against the grit. List out all costs, visible and hidden, and weigh them against the potential returns. Factor in aspects like appreciation in land value, potential rental income if you’re planning on building, and tax benefits if any. This exercise will paint a clearer picture of your investment.

VI. The Future of Land Buying

Peering into the crystal ball, several trends could shape the future of land buying:

- Climate Change: Global warming could impact land values, especially in coastal areas. It’s wise to consider how changes in climate might influence the value of your land in the future.

- Zoning Laws: As cities grow and rural areas become more developed, zoning laws can change. These changes could impact what you can do with your land and its value.

- Virtual Real Estate: The concept of owning virtual land in digital worlds is gaining traction. While it won’t replace physical land, it could impact the real estate market and traditional concepts of land ownership.

Conclusion

Embarking on the journey of buying land in the US can indeed feel like unearthing hidden treasures, with each step revealing something new. But much like any treasure hunt, this venture comes with its share of hidden costs and challenges.

From legal and environmental fees to future costs, these hidden charges can quickly add up and significantly impact the overall cost of your investment. The key to successful land buying is thorough research and preparation. Understanding local real estate laws, getting a professional survey, and considering both ongoing and future costs can go a long way in helping you manage these hidden costs.

Furthermore, understanding your financing options and seeking the guidance of experienced real estate professionals can ensure you’re well-equipped to navigate your land buying journey. Always remember to conduct a thorough cost-benefit analysis to weigh the potential returns against the expenses.

As we look towards the future, keep in mind the potential impact of factors like climate change, changes in zoning laws, and even the rise of virtual real estate. Staying informed about these trends can help you make wise and profitable decisions.

Ultimately, understanding the hidden costs of buying land isn’t about discouraging you from investing. It’s about equipping you with the knowledge to invest wisely, manage unexpected expenses, and turn a potential landmine into a veritable goldmine. So, tread wisely, for when it comes to buying land in the US, what you know can definitely help you!

FAQs

What are some hidden costs when buying land in the US?

A: Hidden costs can include legal and transactional fees, environmental and survey costs, maintenance and future costs, and potential tax implications.

How can I manage hidden costs when buying land?

A: Understanding local real estate laws, getting the land professionally surveyed, and budgeting for ongoing and future costs can help manage hidden costs.

What are some key questions to ask when buying land?

A: Asking about zoning restrictions, tax implications, and any liens or encumbrances on the land can help uncover potential hidden costs.

Why do hidden costs matter when buying land?

A: Hidden costs matter because they can significantly increase the overall cost of your investment. If not taken into account, these unexpected expenses can cause financial strain and potentially make your investment less profitable.

Are these hidden costs exclusive to the US?

A: While the specifics might differ, the concept of hidden costs in land buying is universal. It’s always essential to understand all possible expenses, whether you’re buying land in the US or elsewhere.

Can I negotiate these hidden costs?

A: Some costs, like legal fees or survey costs, may be negotiable. However, other costs, such as taxes or zoning fees, are typically set by local laws and regulations and are not negotiable.

Can hidden costs be avoided?

A: While you can’t avoid all hidden costs, you can certainly manage them. By doing your homework and understanding what to expect, you can budget for these expenses and avoid unexpected financial surprises.

What’s the role of Vacant Land Bargains?

A: Now that you’ve learned about the complexities of buying land in the US, why not let a dedicated team of professionals guide you through this process? Here at Vacant Land Bargains, we stand ready to provide you with an excellent and personal service.